The launch by Lloyds Bank of its new in-app gambling spend limit feature will give those most vulnerable to gambling harm an important means of controlling their gambling

One of the largest banks in Europe has launched a trial program where customers can set personalized monthly limits on how much they spend on gambling with their debit card.

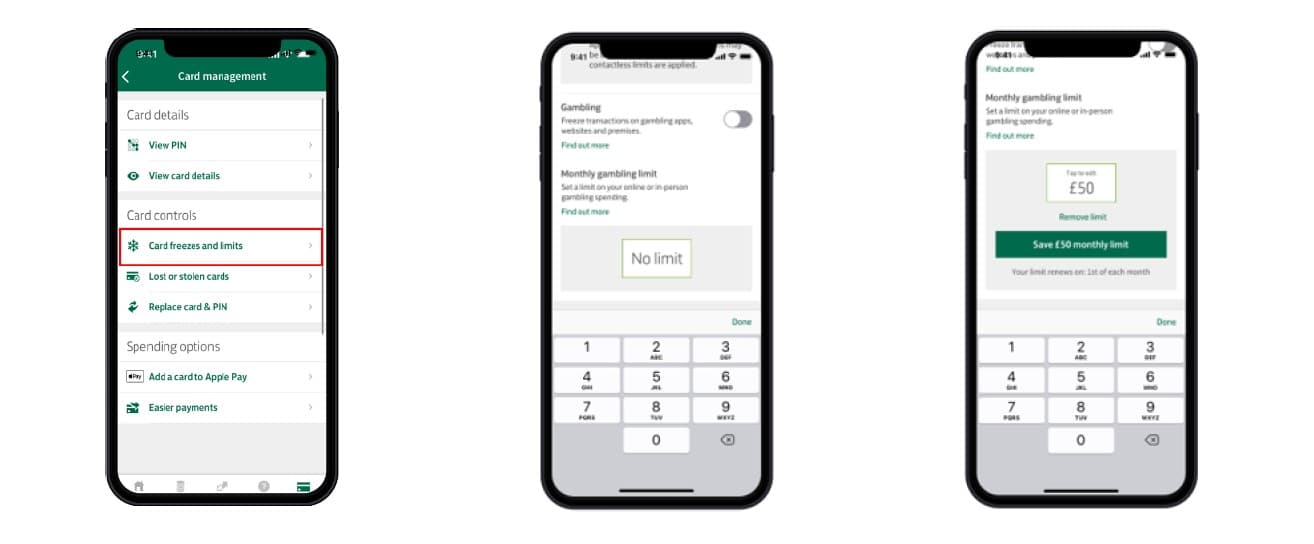

Lloyds Bank, the largest retail bank in the UK and a subsidiary of Lloyds Banking Group, said the feature allows customers using the Lloyds Bank mobile app to set monthly debit card gambling limits to the nearest whole pound. Limits can be set for online, in-person, or over-the-phone spending.

Philip Robinson, Director for Personal Current Accounts at Lloyds, said the bank has been working to help its customers limit how much they spend on gambling for years.

“Our newest feature lets customers set a personalized gambling spend limit, helping them better manage their money and establish boundaries around certain spending behavior,” Robinson said.

The monthly debit card gambling limit feature is available for customers of Lloyds Bank using the mobile app. It will soon be available for customers at Halifax and Bank of Scotland — two other banks owned by Lloyds Banking Group.

Once applied, the limit will prevent a customer from going over the limit when using an individual debit or credit card on gambling apps or websites. Limits can be adjusted or removed at any time and will automatically roll over each month until the customer removes the limit.

“As many households are having to think more carefully about their budgets, the launch by Lloyds Bank of its new in-app gambling spend limit feature will give those most vulnerable to gambling harm an important means of controlling their gambling — and preventing harms from escalating,” said GamCare CEO Anna Hemmings. GamCare is a UK-based charity focused on problem gambling.

“This tool complements the range of existing support features that we can recommend to people reaching out for help.”

According to Lloyds, the feature is a first for a “high street” bank in the UK. High street banks are large financial institutions, and in the UK, the term is used to describe the biggest banks in the country — Lloyds, Barclays, HSBC, and NatWest Group (formerly Royal Bank of Scotland Group).

When Lloyds announced the trial program in mid-November, it cited data from a survey commissioned by the UK’s Gambling Commission (UKGC) one year earlier that found roughly 1 in 3 adults in the UK gamble (excluding lotteries).

UKGC estimates that up to 3% of UK adults are at some risk of harm from their gambling. The agency estimates that 0.3% of adults have a gambling problem.

Meanwhile, a separate survey conducted by Lloyds found 50% of respondents want banks “to take further action to help prevent gambling harm, with monthly gambling limits being one of the most supported features amongst respondents.”

Lloyds said the monthly debit card gambling limit was being launched to help researchers understand how helpful the feature is for customers.

The new feature isn’t the first time Lloyds has tried to boost responsible gambling measures.

In November 2019, Lloyds launched a gambling freeze feature that allows customers to block all gambling payments for 48 hours. The freeze option is available on debit and credit cards through Lloyds Bank, Halifax, Bank of Scotland, and MBNA.